For many seniors in 2026, the home equity represents the largest portion of net worth. However, A houserich, cash-poor retirement can be stressful. While reverse mortgages, specifically the Home Equity Conversion Mortgage (HECM), are designed to solve problems which often surrounded by persistent misconceptions.

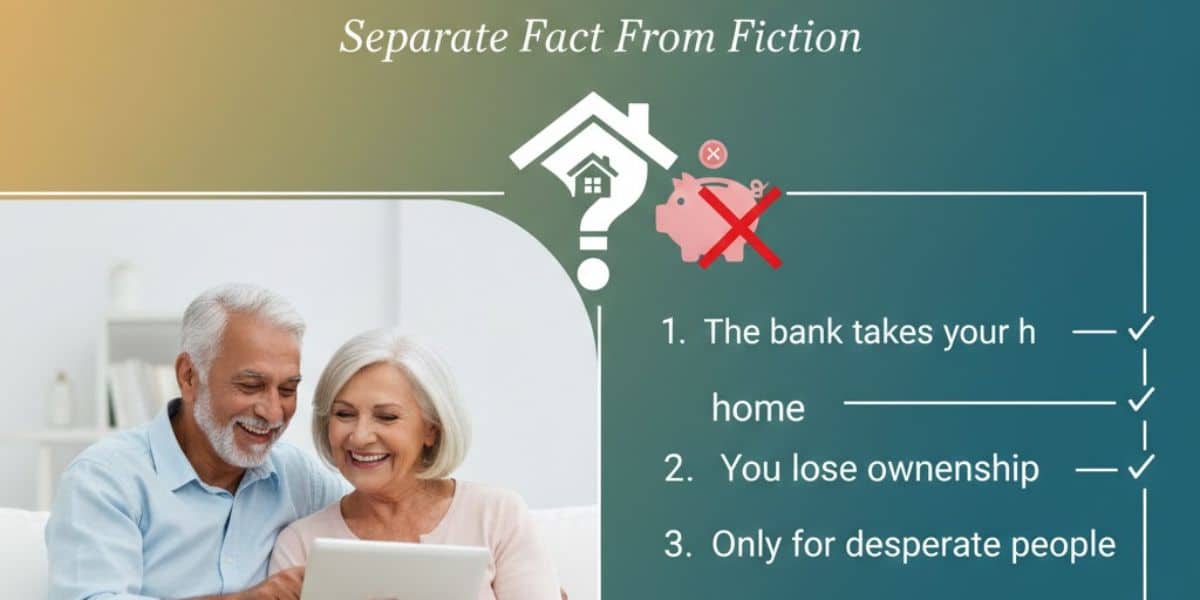

Top 5 Myths About Reverse Mortgages