Current Mortgage Rates In Orlando – Orlando, Florida is a bustling city popular for its world-famous amusement parks, lovely climate, and flourishing tourism economy. People love to make this place their home. However, it’s critical to remain up to date on current mortgage rates in Orlando if you’re thinking about purchasing a property here. These rates may significantly affect the monthly payments you make and your capacity to pay for everything.

Because several significant factors affect the mortgage market, being aware of these issues may assist prospective homebuyers in making educated selections. Therefore, we present you a unique and up-to-date guide on the current mortgage rates in Orlando.

Calculate Mortgage Interest Rates For Orlando Using Mortgage Calculator

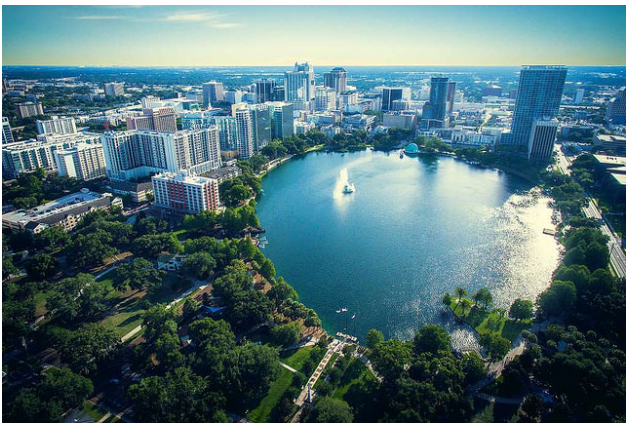

Let’s Know More About Orlando, Florida

Orlando, Florida, frequently referred to as the “Theme Park Capital of the World,” boasts a thriving economy and high standards of living. The presence of famous tourist destinations like Walt Disney World and Universal Orlando Resort guarantees the city a steady stream of revenue and matchless commercial prospects. Orlando’s rich food, nightlife, and cultural customs may be beneficial for investors and moving firms.

The excellent level of living in the city is a result of its first-rate medical care, first-rate educational resources, and lovely surroundings. This is an attractive place for launching businesses and building a bright future, and enjoying stunning beaches and other natural wonders.

The Real Estate Market And Housing Affordability In Orlando, Florida

A. Profitable Real Estate Market

Orlando, Florida is popular for its widespread tourist attractions, pleasant climate, and expanding real estate market. However, the affordability of housing has turned into a significant concern due to rising real estate costs and increased demand.

In May 2023,the Orlando home market registered 3,150 transactions. This is 13.9% from all sales in April, according to Norada. However, in May 2023 sales of 3,946 units were 20.2% less than May 2022 sales.

According to Redfin, Orlando’s median house price in June 2023 was $390,000, an 8.3% rise over the previous year. Homes in Orlando now sell after an average of 17 days on the market compared to last year, showing higher demand and competitiveness.

B. Housing Affordability Challenges

The average cost of a home in Orange County, Florida, is $382,476 based on data from FREEandCLEAR. To buy the median-priced house, a buyer would require a $344,228 mortgage and a yearly salary of $79,791. With a typical household income of $65,780, the affordability discrepancy is obvious.

The affordable home price in Orlando is around $315,314 depending on household income, or 82% of the median home value. These numbers show how expensive life is in Orlando.

Current Mortgage Rates In Orlando

According to several financing-related factors, these rates could fluctuate. Your credit history, the size of the loan, and other variables may also have an effect on the interest rate on your mortgage. To choose the right mortgage program for you, speak with a reliable mortgage lender or broker.

As of Tuesday, July 27, 2023, Zillow has listed Orlando, Florida’s mortgage rates as follows:

- Mortgage rates for 30-year fixed homes in Florida drop to 6.50%.

- From 6.59% to 6.50%, the current average 30-year fixed mortgage rate in Florida dropped nine basis points. Mortgage rates in Florida are currently 2 basis points higher than the 6.48% national average rate.

- The Florida mortgage interest rate on July 18, 2023, is down 15 basis points from last week’s average Florida rate of 6.65%.

- Additionally, the current average 15-year fixed mortgage rate in Florida decreased 5 basis points from 5.81% to 5.76% and the current average 5-year ARM mortgage rate is equal to 6.62%.

How To Secure The Best Mortgage Rates In Orlando?

- Timing Considerations for Rate Locks: It’s vital to time your rate locks since mortgage rates change every day. Given that rates have been steadily moving upwards, it might be prudent to lock-in your rate if you like it on any given day. To make wise judgments, borrowers should keep an eye on market developments and collaborate closely with lenders.

- Strategies for Negotiating with Lenders: To obtain better mortgage terms and rates, gather several offers, assess them, and benefit from the competition between lenders. The likelihood of a successful negotiation can be increased by providing strong credit scores, complete income and asset documentation, making a larger down payment, or factoring in points or discount fees.

- Exploring Refinancing Options: Refinancing may result in lower combined payments for Orlando homeowners, especially if you are paying off high interest rate credit card debt. . Before refinancing, it’s crucial to evaluate possible savings, and accounts for closing expenses, and consult with mortgage professionals.

- Assistance Programs and Grants: In Orlando, first-time buyers may be eligible for grants and assistance programs that provide aid with the down payment, lower mortgage rates, or waived closing expenses. Homeownership becomes more attainable by researching and learning more about these possibilities.

- Understanding Closing Expenses and Down Payments: First-time homebuyers should factor closing costs (appraisal fees, title insurance, underwriting fee, notary, processing, prepaid interest, homeowners insurance, etc.) and down payments (often 3% and higher of the purchase price) into their budget when planning for a property.

- Common Pitfalls to Avoid: Common traps to avoid include exceeding the budget, forgoing mortgage pre-approval, and bypassing extensive property inspections. To handle these difficulties, seek advice from mortgage advisors and real estate experts.

Take Away

Reliance Financial is available to help you locate the ideal mortgage to help you achieve your ambition of becoming a homeowner in Orlando, Florida. We take pride in being a respected mortgage provider with a track record for quality and a dedication to servicing the Orlando region.

Our mortgage advisors are prepared to give you the finest home-buying experience possible, making sure you have the knowledge, guidance, and support to make the right mortgage decision. To start your journey towards homeownership in Orlando, reach out to us at sales@reliancefinancial.com.

Frequently Asked Questions About Current Mortgage Rates In Orlando

Q1: How are mortgage rates determined?

Mortgage rates are determined by the amount borrowed and personal credit profile like credit history, loan terms, and down payment, combined with greater economic factors like the Federal Funds rate, inflation, the housing market, and the overall economy.

Q2: Does my credit score affect my mortgage rate?

Yes, your mortgage rate can be affected by your credit score. Lenders assess the risk of lending based on your credit score and previous financial actions. As a result, the interest rates a bank gives you frequently correlate with your credit score. The good news is that there are steps you can take to help build your credit before applying for a mortgage, such as making on-time payments, refraining from taking on more debt, and paying off past-due accounts.

Q3: What is the difference between interest rate and APR on a mortgage?

The expenses a borrower pays when taking out a mortgage are expressed in two distinct ways: interest rates and annual percentage rates (APR):

The interest rate refers to the cost of borrowing, expressed as a percentage, of the mortgage’s principal amount. This rate serves as the foundation for the borrower’s monthly payment.

The annual percentage rate (APR) accounts for both the interest and any and all financing costs related to the loan, such as discount points or lender origination fees. Since APR is intending to display a loan’s overall cost, using it to compare loans from several lenders is highly recommended.

When displaying a rate that the lender is offering, they must disclose the loan’s APR and interest rate to help the borrower understand the true cost of what they’ll be responsible for paying.

Q4: How often do mortgage rates change?

Mortgage rates change daily based on market conditions, news that impacts the overall economy, the Federal Reserve monetary policy decisions, and any events of significant impact. Rates sometimes change 2 to 3 times in a day.